Ups and Downs of Iranian معجون الطماطم Industry

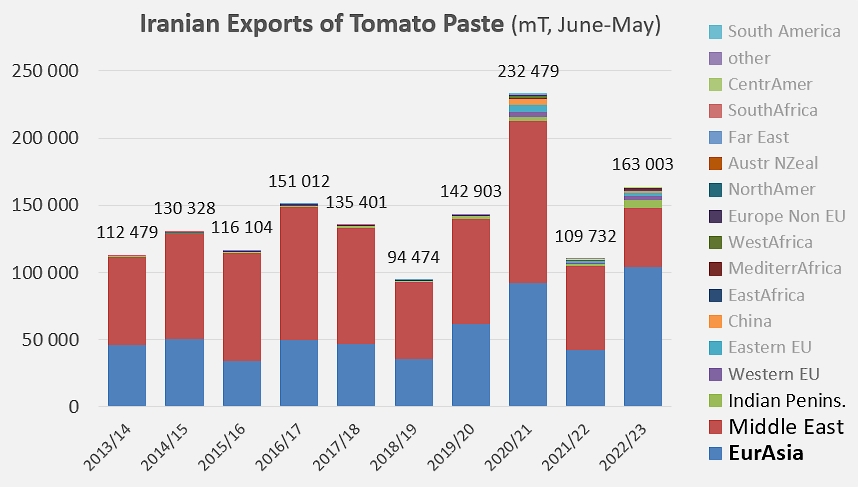

The Iranian industry experienced fluctuating results in foreign trade of tomato products for two years before returning to normal in the 2022/2023 marketing year. During the last marketing year, 163,000 metric tonnes (mT) of paste were exported from June 2022 to May 2023, maintaining the trend seen before the pandemic, with 233,000 mT in 2020/2021 (a 63% increase) followed by a drop to 110,000 mT in 2021/2022 (a 53% decrease). While foreign involvement in the Iranian supply chain is typically inconsistent, the fluctuations seen in the past three to four years have been greater than the usual changes due to agricultural and industrial trends or the purchasing behaviors of key buyers of Iranian goods.

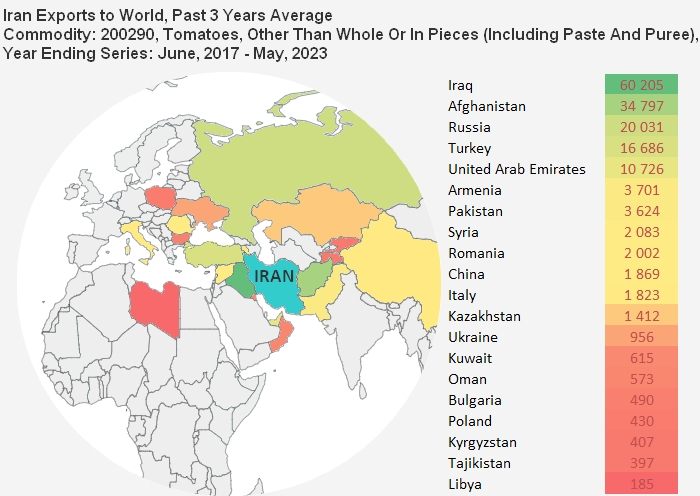

Primary purchasing nations are situated within a limited trade zone, encompassing nearby countries (Iraq, Afghanistan, Turkey, Pakistan) or those with close proximity (Syria, Emirates, Kuwait, Armenia, etc.), alongside a handful of more distant markets (Russia, China, Italy, etc.). In general, Iranian exports continue to target fewer than six markets, representing an average of 85% of shipments in the last three years.

Iran’s Presence in the Canned Tomato Industry

Iran hardly has any presence in the canned tomatoes industry. Nevertheless, the data from the country’s customs services indicate a favorable trade balance, with 135 tonnes of exports in 2019/2020 and 276 tonnes in 2022/2023, mostly headed to the Iraqi market.

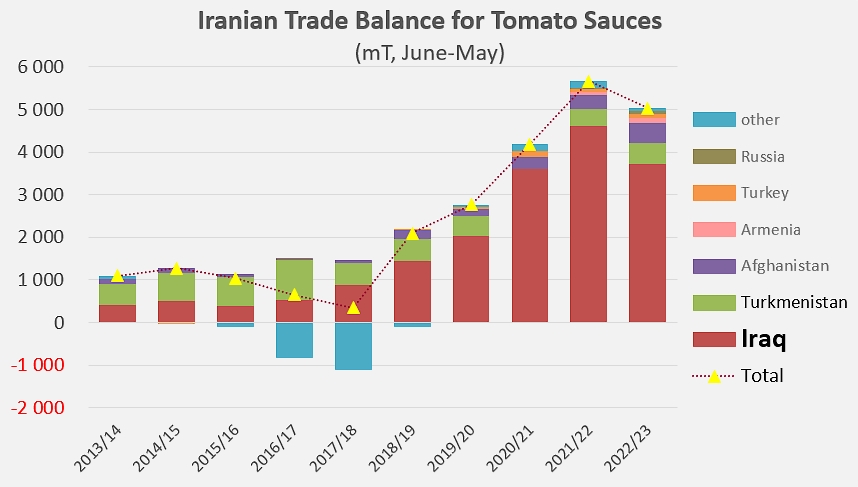

Sauce trade numbers differ greatly from paste, previously at 2,000 mT yearly, but have recently increased to about 5,700 mT in 2021/2022 and 5,000 mT in 2022/2023. The outlets for tomato pastes are also the outlets for destination, being primarily in Iraq (averaging 78% over the last five years), followed by Turkmenistan (10%) and Afghanistan (7%).

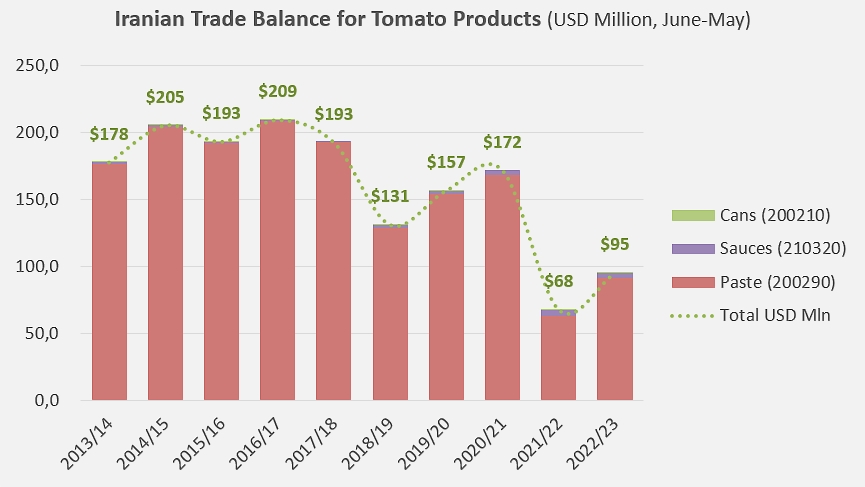

All in all, Iran’s trade balance for tomato products regularly shows a surplus, driven mainly by foreign sales of tomato paste. Paradoxically, however, the value of this surplus has been eroded considerably in recent years, as a result of variations in the quantities mobilized, but also due to a sharp decline in the price of Iranian products : according to figures provided by the country’s customs authorities, the unit value of a tonne of paste will have fallen from around USD 1,570 /mT in 2013/2014 to around USD 570 /mT in 2022/2023.

As a result, the trade surplus, which reached almost USD 210 million in 2016/2017, stood at just USD 95 million last year.

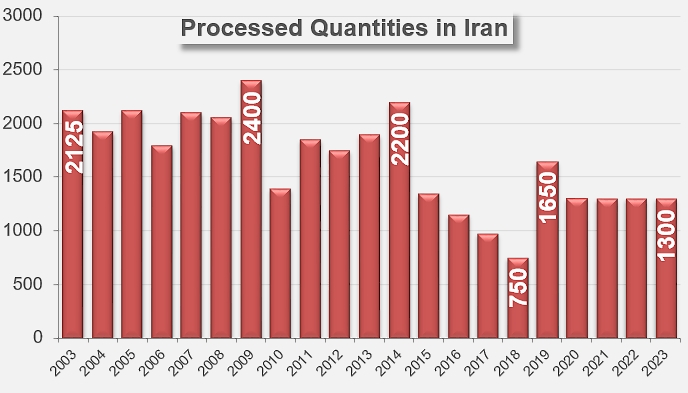

It is projected that around 1.3 million metric tons will be processed in 2023

Average yearly export of tomato paste from Iran over a span of three years.

5 أفكار عن “Ups and Downs of Iranian Tomato Paste Industry”

Thanks for your helpful article

It was amazing and full of knowledge

This article was great. It shows that Iran’s tomato paste export could go higher in the coming years

It sound a fair assess of market today

I read it and I learned a lot

Fantastic, detailed, and straightforward

I’m currently in talk with this company to buy 3 TEU, they cooperate very good

🙏